Market Commentary

Short-Term Investment Lessons from our Local Hockey Heroes

November 16, 2023

As 2023 draws to a close, investors continue to contemplate the same 3 questions from the beginning of the year:

If there’s one thing that the last 12 months have taught us, it’s that no one knows the answer to these questions.

Even the Chair of the US Federal Reserve, Jerome Powell, acknowledged on November 9th that “Inflation has given us a few head fakes” and that “If it becomes appropriate to tighten policy further, we will not hesitate to do so.”

So if the guy in charge of the biggest bank in the world doesn’t know if things are going to get better or worse … how are the rest of us supposed to decide what to do? Whether you only occasionally skim financial headlines … or your full-time job is in capital markets, you probably have to acknowledge by now that any short-term predictions you might have had made in the past probably haven’t panned out. Just like fans of Western Canadian NHL teams, short-term market results can be unpredictable … yet both incredibly frustrating and sometimes unexpectedly rewarding.

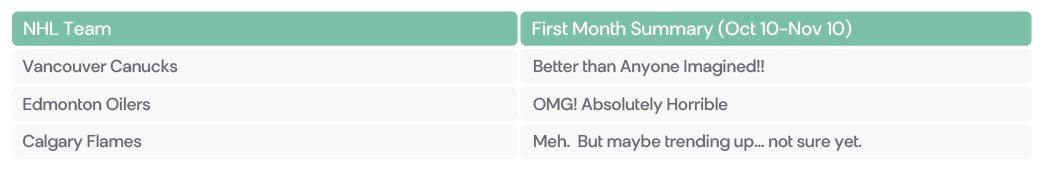

Consider the following NHL fan bases 1 month into the season:

Fortunately, the financial implications of rooting for your favorite hockey team are very different than allocating your investment portfolio (unless perhaps you’ve been attracted by the new fascination with online sports betting … but that’s a horrible retirement planning strategy!). But there are still some parallels, and learnings, that we can draw from the start to the NHL season

3 Investment Lessons that we Can Learn from our Local Hockey Heroes

Let’s explore each of these in turn

1. Short-Term Performance can be Frustratingly Unpredictable

Like hockey players/teams, public market securities (or asset classes) often deliver results that defy logic. Both fans and investment professionals can spend countless hours researching their team/portfolio, assessing their potential, and ending up with significant conviction in the road ahead. But whether you are a hockey fan or market predictor, you have probably had to reluctantly conclude the following:

- Short-term surprises are much more common that we expect

- Losing streaks sting more than winning streaks soothe

- Hindsight shows that reactions to losing streaks are usually wrong

- Not reacting to losing streaks doesn’t feel right

- Trends can sometimes be helpful predictors… except for all those times that they aren’t.

Recent market performance has been as confusing as the start to the NHL season. We’ve had stretches of extraordinary performance on the upside (the first 3 days of November were the best we’ve seen this year for both the public bond and equity market) and on the downside (most of September). And the triggers for these streaks aren’t always intuitive or obvious (the early November streak being primarily driven by new consensus that the economy isn’t growing as quickly and rates may not rise further).

2. Don’t Put All Your Eggs in One Basket

In the investment world, we use the term ‘diversification’ to describe the importance of this philosophy. In the hockey world, we talk about ‘depth’. Time and time again, successful NHL teams are showing that a balanced approach to roster construction (depth) wins over a skewed approach (a few superstars along with a weak supporting cast). At Wealthco, we believe that long-term successful investment results starts with a very well diversified portfolio. And a few other principles which NHL General Managers should keep in mind as well!:

- A successful team has a variety of player types. Some are typical … others might be alternatives. Together they build a successful team!

- Balance your portfolio with young, maturing, and seasoned assets.

- Don’t overpay for assets nearing the end of their useful life.

- Make sure there’s always a few you can trade if you need to.

- Scouting for new investments, and research on other options (due diligence!), is important.

3. Defence Wins Championships

It seems that regardless of the professional sports league (hockey, football, baseball, etc.), there’s a growing recognition that at the end of the day, defence wins championships.

Flashy offensive superstars are often appealing and can provide short-term success from time to time, but it seems that every year when the champion is crowned, the title goes to the team that did the best job of managing bad outcomes.

WealthCo’s investment philosophy is very much aligned with that principle. Our portfolios are built to emphasize downside protection over upside capture … meaning defence comes first! That doesn’t mean we don’t have any goal scorers on our team (we do!), but the primary goal is to avoid measurable portfolio losses when markets are tough. And that over the long-term, we’ll come out ahead of the pack.

We’re very pleased with our relative performance in that regard, in particular since the market downturn which began at the beginning of 2022. A WealthCo balanced investor’s return was such that the drawdown incurred in 2022 was restored byApril 2023, while typical retail balanced investors are still no where close to recovering their losses of 2022.

Disclaimer:

WealthCo fund performance figures are presented net of investment management fees. Our Global Equity Benchmark is the MSCI All Country World Index. This benchmark is the institutional standard for global equity benchmarking of diversified equity portfolios. It represents the market weighted performance of nearly 3,000 stocks (or approximately 85% of the global investable equity opportunity set). Our Fixed Income Benchmark is the FTSE Canada Universe Bond Index. This benchmark is the institutional standard for Canadian fixed income benchmarking of diversified investment grade portfolios. It represents the performance of the Canadian dollar denominated investment-grade fixed income market.

WealthCo Asset Management Inc. is a subsidiary of The WealthCo Group of Companies and is licensed to use the “WealthCo” trademark. WealthCo. Asset Management Inc. (“WealthCo”) is registered as an Investment Fund Manager in the province of Alberta. It holds a Portfolio Manager registration in the provinces of Alberta, British Columbia, Manitoba, Northwest Territories, Ontario and Saskatchewan and an Exempt Market Dealer license in the province of Alberta. The information provided herein is for general information purposes and should not be construed as an offer to purchase, sell or trade in securities. Important information regarding the WealthCo funds discussed herein is set out in the fund’s trust agreement. A copy can be obtained from info@wealthco.ca. The historic returns and their relative performance shown herein may not be indicative of future returns. Past performance is not indicative of future results. Performance cannot be guaranteed.

Related Posts