Simplifying your financial life with integrated planning, investing, risk management, and estate planning solutions.

Helping aging parents

Saving for retirement

Buying a house

Starting a family

Managing cash flow

Insurance planning

Helping aging parents Saving for retirement Buying a house Starting a family Managing cash flow Insurance planning

We focus on your finances

you focus on what matters to you

We simplify your financial life, allowing you to focus on what matters most to you. Our expert advisors provide you with personalized strategies, offering you peace of mind and a clear path to your goals.

Everything you need

to navigate your financial future

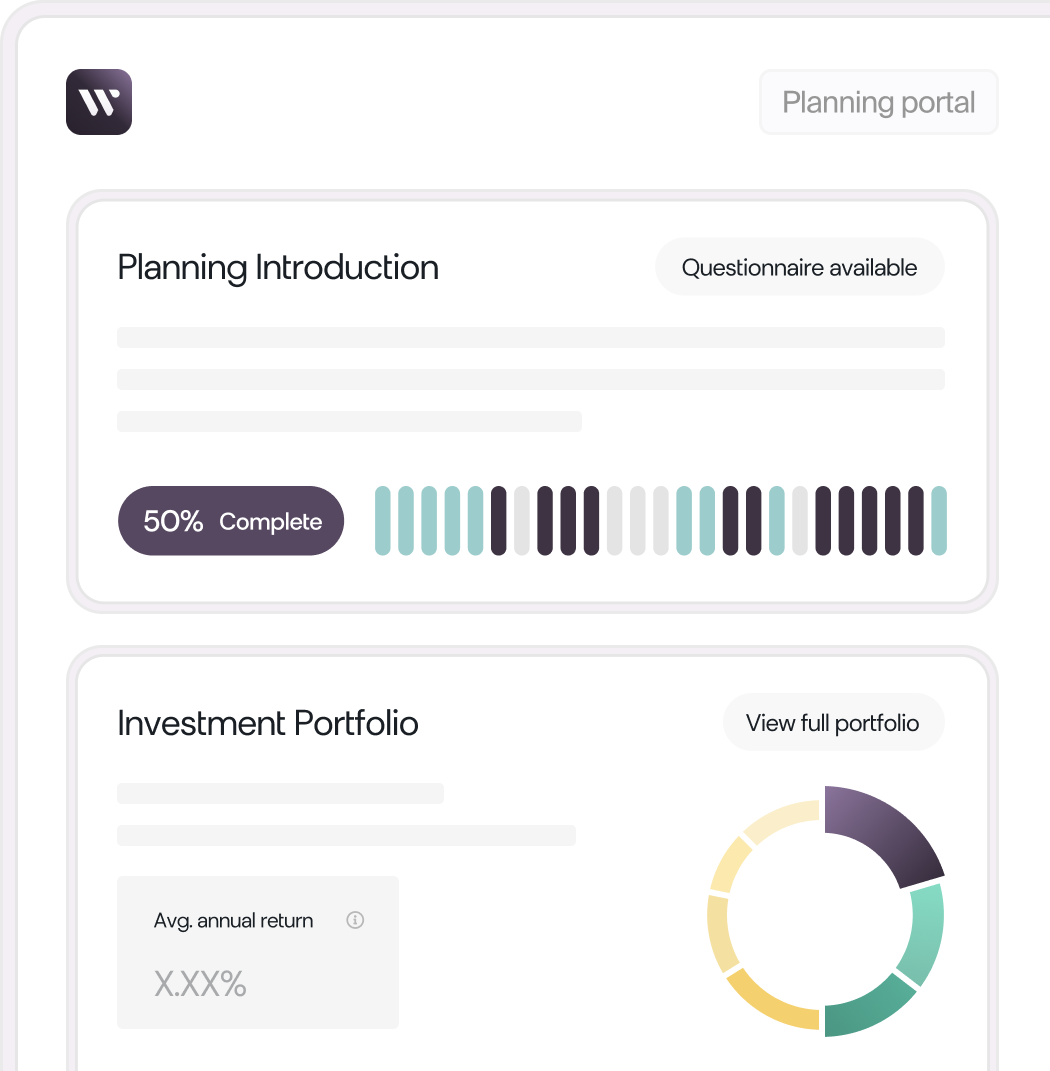

Integrated planning

personal and business

We specialize in crafting comprehensive financial plans that incorporate advanced strategies to safeguard and increase your wealth. Our services encompass retirement, tax, estate planning and more.

Learn more

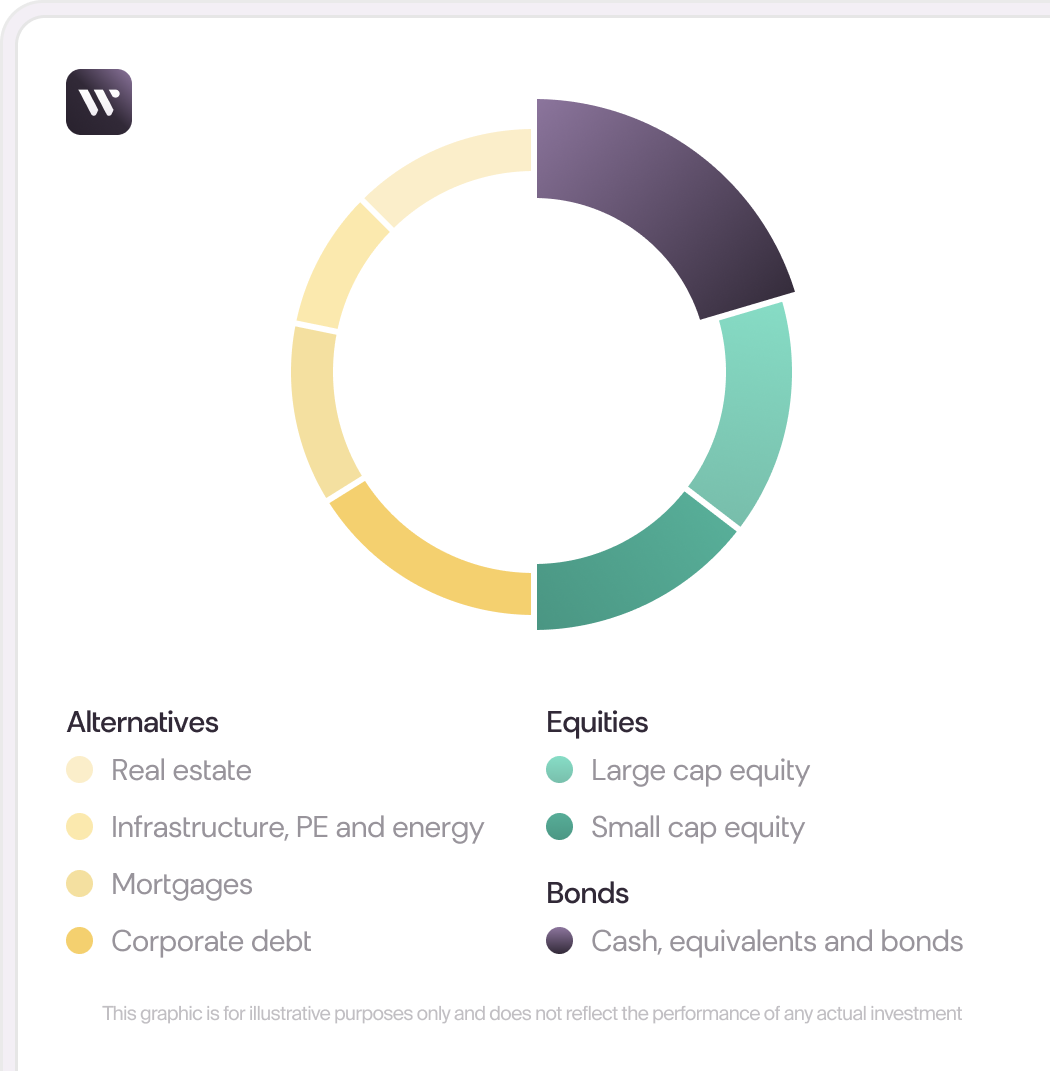

Diversify among

institutional grade assets

We craft institutional-grade portfolios blending public and private investments in real estate, venture capital, and fixed income. Our tax-efficient strategies and dynamic rebalancing ensure optimal performance.

Learn more

Protect your family

protect your wealth

Safeguard your financial future with tailored insurance solutions from WealthCo. Our solutions include life, disability, critical illness, and more, ensuring comprehensive protection for you and your loved ones.

Learn more

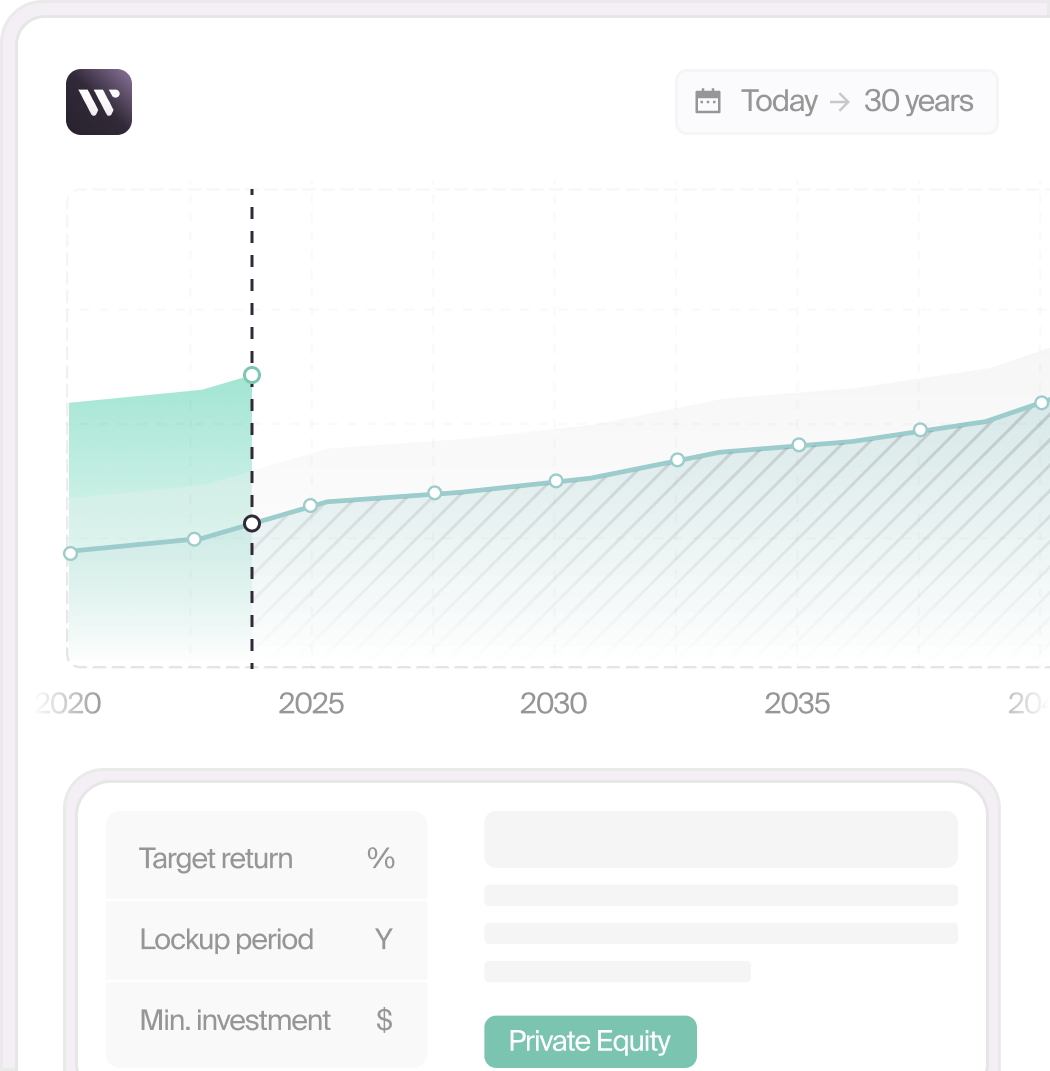

Plan for retirement

on your terms

Shape your retirement vision with our strategic planning. Whether it's a "work-optional" lifestyle or world travel, our Certified Financial Planners ensure a stress-free planning experience tailored to your dreams.

Learn more

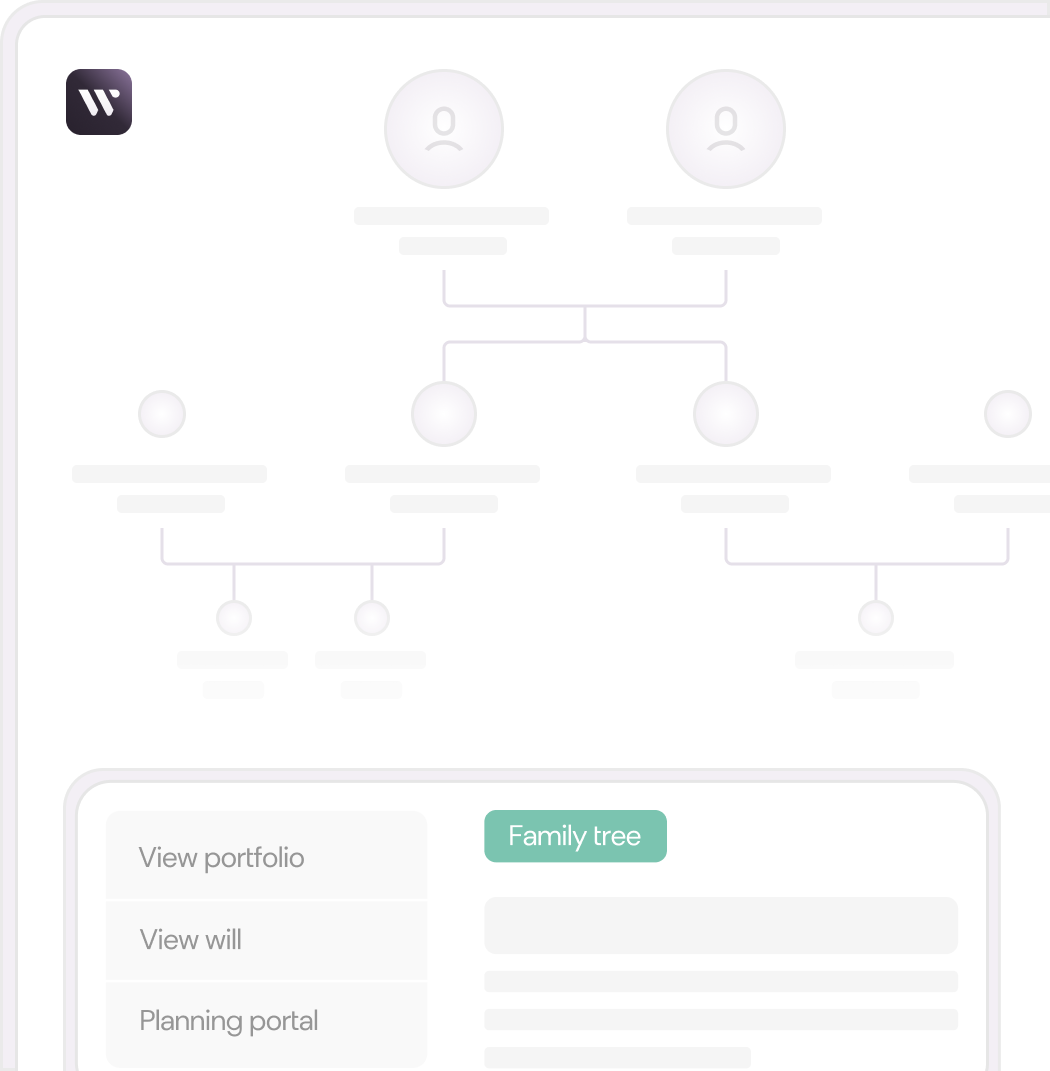

Leave a legacy

you’re proud of

Secure your legacy with personalized estate planning. We help you navigate your will, trusts, tax strategies, and asset protection to preserve your wealth for future generations by working alongside your advisory team.

Learn more

Bespoke private

wealth solutions

WealthCo Asset Management Private Wealth services help you simplify the complexities of your financial world so you can enjoy the life you've worked hard to build.

Learn more

Have a question,

challenge, or opportunity?

No matter how complicated or big your problem may seem, our experienced and talented team of advisors can help.

Learn more

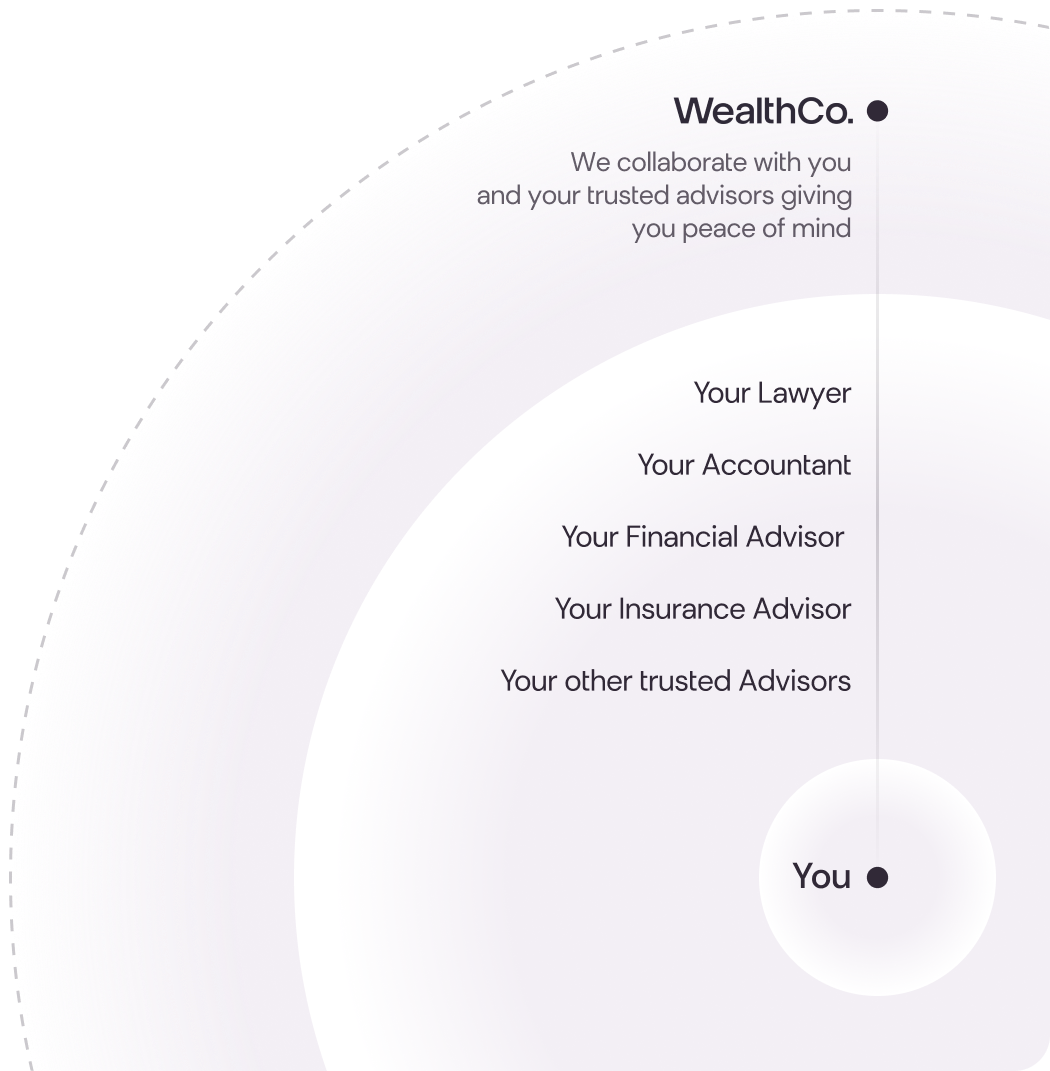

The Integrated Advisory Experience

WealthCo is a proud member of the Integrated Advisory Professionals Network

Advice from an

experienced team

David Udy

Sophie Blais

Dave Makarchuk

Jeanne Oppenheim

Jeff Dyck

Claude Spencer

Debjani Saha

Navneet (Nanu) Parhar

Owen Komperdo

Howard Wong

David Llewellyn

Rob Margeson

Smarika Duggal

Shawn Samuel

About WealthCo

A proven process designed for peace of mind

Fully managed approach designed to scale dynamically with you

1

Discover

We start by uncover what matters most to you and getting clarity on where you want to be financially, personally and professionally.

2

Advise

With a clear understanding of what you want to achieve we offer sound advice and outline a path forward that aligns with your priorities.

3

Implement

Our team of specialists implement the agreed upon advice given and together we measure, track, and adjust your plan as needed.

4

Review

We remain present and active as your life evolves with regular review meetings to keep your plan up to date and things change.

Choose WealthCo to help

Protect your family

Plan your estate

Invest in the future

Plan for retirement

If you’re ready to bring clarity and simplicity to your financial life, book a free introduction meeting with one of our team members today.

We are a fiduciary

Wealthco Asset Management is registered as a Portfolio Manager with the Alberta Securities Commission and with other Canadian Commissions. As a Portfolio Manager, we have a fiduciary obligation to our clients. That means that we must place our client’s interests ahead of our own and address any conflicts in the best interests of our clients.

Compare

How WealthCo

stacks up

|

Traditional firm |

|

|---|---|---|

Dedicated financial advisor |

|

|

Integrated business and personal planning |

|

|

Integration with your tax advisors |

|

|

Cash flow and retirement projections |

|

|

Public equities & fixed income |

|

|

Institutional grade alternative investments |

|

|

Diversified investment portfolios focused on downside protection |

|

|

Capital pooling to enhance diversification, lower costs, and provide liquidity |

|

|

Help with setting up an estate plan |

|

|

Personal insurance solutions |

|

|

Business insurance solutions |

|

|

Family enterprise planning (FEA Registered Advisors) |

|

|

One stop for all your wealth management needs |

|

|

Access group benefits |

|

|

Access to a network of specialized and collaborative financial professionals |

|

|

Net worth summary and projections |

|

|

Review of existing unanimous shareholders agreements and partnership agreements |

|

|

Philanthropic planning |

|

|

Wealth protection, Tax minimization and wealth multiplication |

|

|

Summarize and audit existing insurance plans |

|

|

Private wealth management options |

|

|

|

Traditional |

|

|---|---|---|

Dedicated financial advisor |

|

|

Integrated business and personal planning |

|

|

Integration with your tax advisors |

|

|

Cash flow and retirement projections |

|

|

Public equities & fixed income |

|

|

Institutional grade alternative investments |

|

|

Diversified investment portfolios focused on downside protection |

|

|

Capital pooling to enhance diversification, lower costs, and provide liquidity |

|

|

Help with setting up an estate plan |

|

|

Personal insurance solutions |

|

|

Business insurance solutions |

|

|

Family enterprise planning (FEA Registered Advisors) |

|

|

One stop for all your wealth management needs |

|

|

Access group benefits |

|

|

Access to a network of specialized and collaborative financial professionals |

|

|

Net worth summary and projections |

|

|

Review of existing unanimous shareholders agreements and partnership agreements |

|

|

Philanthropic planning |

|

|

Wealth protection, tax minimization and wealth multiplication |

|

|

Summarize and audit existing insurance plans |

|

|

Private wealth management options |

|

|

Testimonials

I was nervous and perhaps a little scared at first. The team followed the financial plan that was put in place after our first meetings to determine my risk tolerance and there has been no looking back. I have complete confidence in their decisions.

Ron N.

Business Owner

FAQ

-

WealthCo offers a wide range of financial services designed to meet your unique needs:

Integrated Financial Planning: Tailored strategies for retirement, estate planning, and overall wealth management.

Investment Management: Expert management of your investment portfolio to maximize returns while managing risk.

Insurance Solutions: Comprehensive insurance options to protect your assets and secure your family's future.

Retirement & Estate Planning: Guidance to ensure a comfortable retirement and effective estate distribution.

WealthCo is committed to helping you grow, protect, and manage your wealth with personalized solutions and expert advice.

-

The fees cover all advisory services; this includes planning and investment management but not embedded costs. Fees are shared between WealthCo and your CPA firm.

-

Our personalized approach, experienced team, and commitment to excellence in service delivery distinguish us from other firms. As members of the Integrated Advisory Professionals Network we can offer a holistic and comprehensive service that addresses all aspects of your financial life.

-

Our fees are transparent and based on a percentage of assets under management, so we do better, when you do better.

Our Insights

Monthly wealth-building insights delivered right to your inbox