Asset management

You deserve a strong financial foundation

Most investors have access to a limited number of investment tools. WealthCo Asset Management invests like major pension plans so you can have peace of mind and confidence in the future.

WealthCo Asset Management is registered as a Portfolio Manager and an Investment Fund Manager with the Alberta Securities Commission and with other Canadian Commissions.

Your financial future shouldn't be stressful

Diversify your wealth

Mitigate your risk

Secure your future

In-depth discussions on the markets

Bringing pension style investing to individual investors

We think of your investments as a mini-pension fund. For many investors, moving towards a pension-style investment philosophy fits nicely with their long-term goals and objectives.

Pension style investing can...

Help grow your savings by focusing on a diversified portfolio

Help you manage risk by diversifying across a range of asset classes

Help you generate income in retirement

Help protect your purchasing power over the long term

Help you avoid making short-term investment decisions

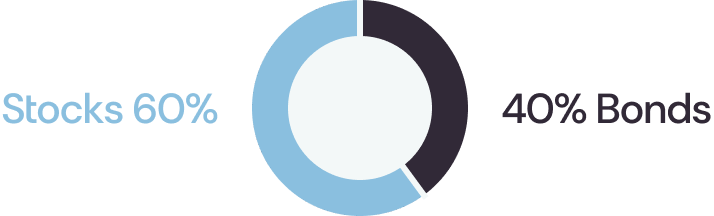

Outgrowing the 60/40 portfolio?

In today's rapidly changing market, the age-old 60% stocks and 40% bonds strategy no longer suffices as optimal diversification.

As an example in 2022, both stocks and bonds declined by over 10%, leaving investors in a traditional 60/40 portfolio feeling the pain of a market correction.

Next-level diversification

The institutional advantage

WealthCo Asset Management embraces a pension-style approach to provide our clients with unique growth potential and an extra layer of diversification beyond the traditional asset classes.

Our value beyond the numbers

An integrated approach

Formulate a plan that considers all aspects of your financial life and make better decisions by working collaboratively with all of your professional advisors.

Capital pooling

Capital pooling provides scale, diversification, and access to alternative investments not otherwise available on retail platforms.

Deeper diversification

All assets are pooled into 4 distinct funds giving you the flexibility and diversification otherwise not available in the retail market.

Peace of mind

We strive for above-average risk-adjusted returns. We’re more concerned about downside protection than upside capture.

Professional sub-advisors

Our funds provide investors access to a diverse set of high quality niche managers.

Spectrum of options

Experience the unparalleled comfort of a diversified portfolio that fits your risk tolerance and financial objectives.

01 / 03

01 / 03

Why alternative investments matter

Alternative investments are assets that fall outside of traditional investments like stocks, bonds, and cash, and generally includes a range of asset classes.

Like adding new players to your investment team, they offer different skills and can help you win more often, defend better when the game gets tough, and make sure you don't rely on just one player. This way, if one player (or investment) isn't performing well, the rest of your team can step in to support.

02 / 03

02 / 03

Distinct diversification made simple

Our client-focused strategy includes four proprietary investment pools: Alternative Income, Fixed Income, Alternative Growth, and Core Equities. Each of these pools offers distinct opportunities and plays a unique role in your overall portfolio.

03 / 03

03 / 03

Less chance, more choice

We cater to your various risk tolerances and financial goals by providing four allocation options: Conservative, Balanced, Growth, and Aggressive Growth. These options allow you to strike the perfect balance between risk and return, based on your personal preferences and financial objectives.

At WealthCo Asset Management you aren't just investing your money - you're shaping your financial future.

Some of our trusted sub-advisors

A proven process designed for peace of mind

Fully managed approach designed to scale dynamically with you

1

Discover

We start by uncover what matters most to you and getting clarity on where you want to be financially, personally and professionally.

2

Advise

With a clear understanding of what you want to achieve we offer sound advice and outline a path forward that aligns with your priorities.

3

Implement

Our team of specialists implement the agreed upon advice given and together we measure, track, and adjust your plan as needed.

4

Review

We remain present and active as your life evolves with regular review meetings to keep your plan up to date and things change.

Don't just manage your money. Protect your financial future.

At WealthCo Asset Management, we understand that your financial journey is more than just numbers on a screen. It's about the hard work you've put in, the dreams you're aspiring to, and the legacy you hope to leave behind. We're here to not only protect and grow your wealth but also to make sure you feel confident and secure about your financial future.

Our unique approach prioritizes extensive diversification, utilizing four proprietary investment pools: Alternative Income, Fixed Income, Alternative Growth, and Core Equities. Based on your risk appetite and financial goals, we align these pools into four allocation strategies: Conservative, Balanced, Growth, and Aggressive Growth. With WealthCo Asset Management, you're not left to the whims of the market. Instead, you become an empowered investor, choosing the strategy that suits your unique situation and goals.

At WealthCo Asset Management we are dedicated to delivering value beyond your portfolio balance. We're committed to being a reliable partner, working with your other professional advisors, to offer a pension-style investment approach and focusing on downside risk mitigation.

Let us guide you through the complex world of investing, and together we'll turn your financial dreams into reality. With WealthCo Asset Management, your wealth is not just managed—it's protected, nurtured, and positioned for sustainable growth.

FAQ

-

We use a comprehensive risk assessment process to build portfolios that balance growth potential with risk mitigation, aligning with your long-term financial goals.

-

Institutional alternative investments, such as private equity, hedge funds, real estate, and commodities, are financial assets not available on public exchanges, typically accessible only to institutional investors. WealthCo values them for their diversification benefits, higher potential returns, lower market correlation, and inflation hedging capabilities, enhancing overall portfolio performance and stability while providing access to unique opportunities.